Is your Business Underinsured?

Lisa Carter, Managing Director - Clear Insurance

Your business is probably one of the most valuable assets you have – so it makes sense to protect it in good times and bad. Inadequate cash flow is one of the major reasons small businesses fail in Australia *1. That’s where having the right level of insurance can make all the difference by helping to ensure your business continues to operate smoothly if the unexpected happens.

The risk of underinsurance

Unfortunately, 1 in 10 Australian businesses with insurance don’t have enough cover to protect themselves against business disruption, legal liabilities or loss or damage to their assets *2.

It’s referred to as ‘underinsurance’ and it can greatly increase the risk of a business having to close down if something goes wrong. So why are so many businesses underinsured?

Some business owners are driven by low premiums and don’t take the time to make sure they are adequately protected after an insurable event. As a result, the sum insured may not be enough to cover losses – or the terms of their policy may limit the amount that can be recovered.

It’s also common for business owners to underestimate either the reinstatement or replacement costs of their business assets after a damaging event such as a fire or storm. If the sum insured doesn’t reflect an up-to-date reinstatement or replacement cost, the owners will be underinsured and may face substantial out-of-pocket expenses if they need to make a claim.

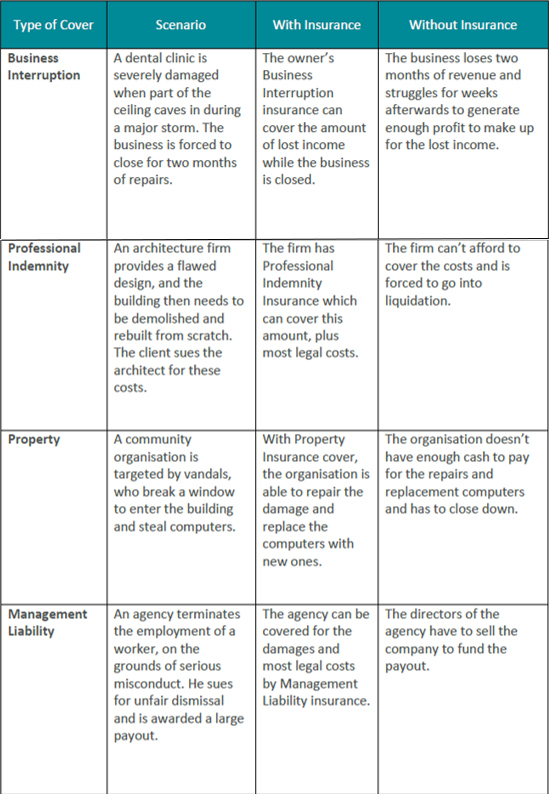

The difference insurance can make.

*1 ASIC, Insolvency statistics: External administrators’ reports (July 2017 to June 2018). *2 Insurance Council of Australia, Non

insurance in the small to medium sized enterprise sector, July 2015

How do you know if you are underinsured?

You are at risk of being underinsured if:

• You haven’t updated your insurance cover to reflect the growth of your business.

• Your insurance is based on an outdated replacement cost of your business assets.

• You are covered for damage to your business premises but have not considered other forms of financial loss such as business interruption

and management liability.

How can your insurance adviser help?

Sorting out your insurance cover often drops to the bottom of your never-ending to-do list. That’s where your insurance adviser can help. They do the hard work of reviewing your insurance strategy, adapting your cover, and giving you peace of mind that your business is properly insured.

If you have any questions, please contact our risk and insurance industry experts, Lisa Carter or Jen Bettridge of Clear Insurance.