Credit Management & The Current State of Play:

How Does the Queensland Leaders Community Stack Up?

Angela McDonald, Managing Director - Optimum Recoveries

In April, my colleague Michael Blonk and I spoke to the Queensland Leaders community about credit management and risk prevention in small to

medium businesses.

During the presentation we asked the audience to respond to credit management questions, providing insight into how their results compared

with other audience members, and discussed useful ideas on how to improve the balance between revenue and loss, and work towards more

effective credit policies.

But how does our little Queensland Leaders bubble stack up against the rest of Australia? Are we in line with the averages, or are we faring better or worse? Using information collected from our audience along with the April, May and June 2021 CreditorWatch Business Risk Reviews, I’ve outlined some of the key questions businesses should ask themselves, and what to keep an eye on in the industry.

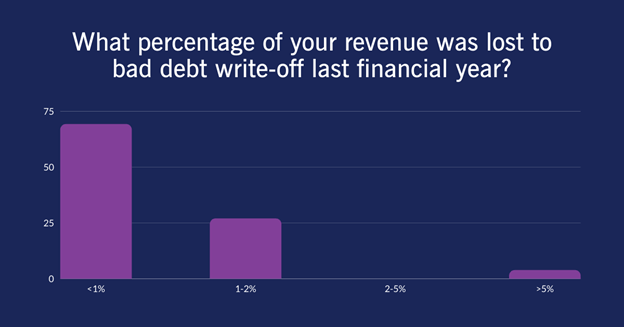

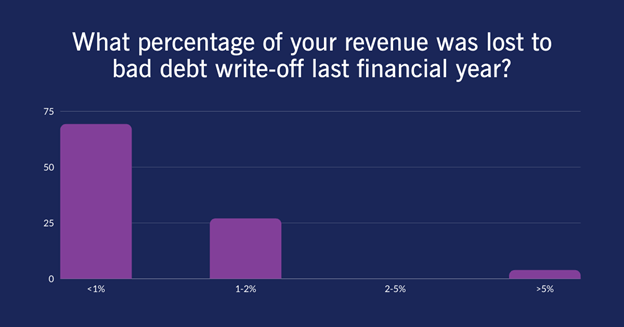

What percentage of your revenue was lost to bad debt write-off last financial year?

When we asked this question almost 70% of the audience responded with a revenue loss of less than 1% in the last financial year. Around 27% responded with 1-2%, and only around 4% responded with a larger loss of revenue, at 5% or more.

Typically, from a commercial point of view the loss is usually around 1% or less, and from a consumer point of view it’s usually closer to 2-3% revenue loss. This was consistent with the results from the audience, who were mostly from the commercial side.

When considering the response to this question, it is important to think about your individual margin; if you have a higher margin then you can often afford to have a higher revenue loss rate, meaning the “right” amount of bad-debt write-offs differs from business to business.

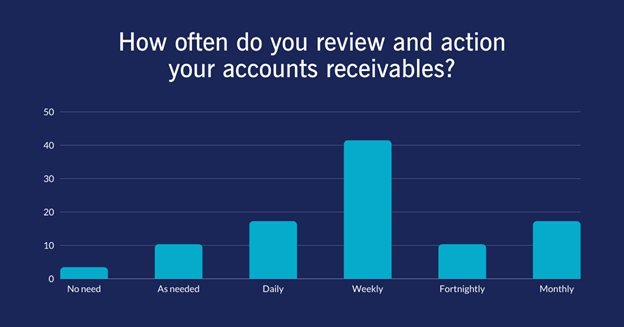

How often do you review and action your accounts receivables?

The response to this question was very promising. I always take the position that it's everybody's responsibility to make sure there's money in the bank; money keeps the doors open and keeps us all employed. Having an understanding of the incoming and outgoing transactions your business is making is vital to keeping your credit on the right track.

The results from the audience were quite varied, and there was a spread across a range of different responses. However, around 41% of the audience responded that they review and action their accounts receivables weekly, followed by either on a daily or monthly basis. Only a few people responded that they only do this when the money gets tight, or that there is no need at all. This shows a great number of Leaders are taking charge of their accounts.

What percentage of your accounts are outside agreed terms?

This was an interesting question, and half of the audience responded that only 10% or less of their accounts are outside agreed terms. Additionally, around 25% of the audience responded with between 10-25%, 15% of the audience responded with 25-50%, and 12% of the audience actually responded that none of their accounts are outside agreed terms.

These percentages are naturally going to be different for different industries, for a whole range of reasons, so the challenge for businesses is, of course, how much risk can you take?

With current record low interest rates, businesses can afford more extended terms that may lure customers in from other providers. This is not something that is normally on the table, but with the way things are at the moment, it’s important to understand the current circumstances and take advantage of any opportunities.

But again, the challenge is figuring out how much risk your business can afford to take, and balancing this risk with the potential benefits. You might have a 2% loss, but that means you have 98% good customers, and you don’t want to lose your good customers because your credit policy is too risk averse. A good balance is important.

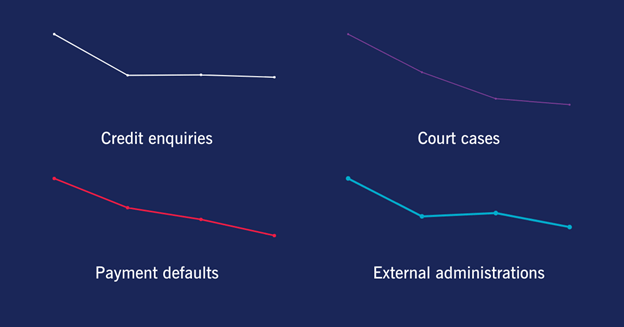

Key Trends in the Credit Industry from April to June 2021

The April 2021 CreditorWatch Business Risk Review shares some positive trends for creditors with payment defaults well below where they were the same time last year during the peak of COVID-19 in Australia. Although many sectors are still picking up the pieces and have reported decreases in payment times compared to previous months, this is expected as JobKeeper measures come to an end.

March to April 2021:

Credit enquiries decreased 28.5%

Court cases decreased 29.1%

Payment defaults decreased 19.7%

External administrations decreased 26%

But, 17 out of 19 industry groups reported an increase in the time it took to pay their bills with Construction, Administrative Services and

Healthcare being the slowest.

The May 2021 CreditorWatch Business Risk Review indicated

that after months of positive news for creditors, there are now some clear signs that economic recovery may be losing momentum after the end

of JobKeeper measures. However, there are still many big picture positive trends for creditors. Credit enquiries have increased by 36% since

last year and payment defaults are still decreasing compared to this time last year, even if this data has fluctuated up and down in the

last few months this year.

April to May 2021:

Credit enquiries increased 4.3%

Court cases decreased 28.5%

Payment defaults increased 9.8%

External administrations increased 3.1%

Enquiries increased based on the preceding months slowing of payment times. Creditors were checking the status of existing clients and the credit worthiness of new applicants and again payment times slowed. Key sectors to keep an eye on include:

- Healthcare & Social Administrative Assistance

- Construction

- Wholesale Trade

- Information, Media and Telecommunications

The June 2021 CreditorWatch Business Risk Review reflects the roller-coaster nature of the economy throughout COVID-19 and shows us that the credit environment is in a much better position than it was the same time last year even with the loss of JobKeeper measures and monthly ups and downs. Credit enquiries may have decreased by 2.3% between May and June this year, but they have actually increased by 32% compared to June 2020.

May to June 2021:

Credit enquiries decreased 2.3%

Court cases decreased 9%

Payment defaults decreased 14.95%

External administrations decreased 22.6%

We can see that between April and June 2021, credit enquiries, payment defaults, and external administrations have been fluctuating back and forth between increasing and decreasing from month to month, whereas court cases have been continuing to decrease each month.

However since the same time last year, we have seen many positive changes with overall increases in the number of credit enquiries and overall decreases in payment defaults across the board. This is great news for creditors and CreditorWatch believes that most businesses across industries will survive these turbulent times and come out the other end.

What does this mean for the QLD Leaders Community?

One of the best things to do now is to really have a look at your accounts from the first half of this year and understand how your business

is tracking compared to broader industry trends. Scrutinising what has happened will help small to medium businesses bounce back from the

hit to the economy and work towards more effective credit management policies.

A good credit policy has an incredible impact on the overall financial health of your business. When analysing your credit policy, it’s

important to not only think about your current customers, but also your customers that went bad, and the ones that you said no to at the

time but may have actually been able to sell more products or services to. This will give you a better understanding of what your credit

policies should look like in the future to serve your business better.

If you are looking for more information on credit management, contact the Optimum Recoveries team via our website www.optimumrecoveries.com.au